What are the German Tax Classes?

German tax class 1: Singles, Widows, Legally Separated

- Applicability: Single individuals, widowed, or legally separated. Tax Class 1 applies to single individuals, widowed individuals, or legally separated individuals in Germany. This means that if you are single, widowed, or legally separated, you fall under Steuerklasse 1.

- Tax Rate: Progressive, higher for higher earners. The tax rate for individuals in Tax Class 1 is progressive, which means that it increases as income levels increase. This progressive tax rate system ensures that higher earners pay a higher percentage of their income in taxes compared to lower earners.

- Advantages: Basic allowances to reduce the tax burden for lower incomes. One of the advantages of Tax Class 1 is the availability of basic allowances. These allowances are designed to reduce the tax burden for lower-income individuals. By taking advantage of these allowances, individuals can reduce their overall tax liability and potentially optimize their tax position.

- Considerations: Understanding progressive rates and applicable allowances. Individuals in Tax Class 1 need to understand how the progressive tax rate system works. As income levels increase, the corresponding tax rate also increases. Understanding the tax rates applicable to different income ranges is crucial for accurate tax planning and compliance.

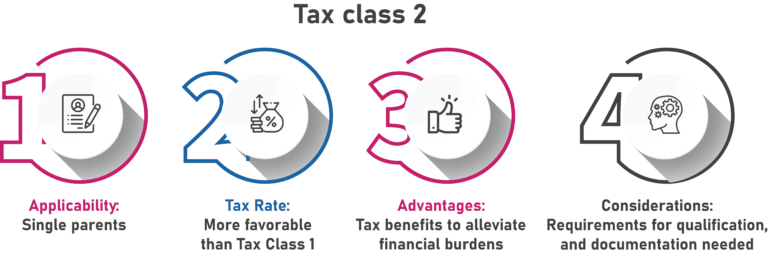

German tax class 2: Single Parents

- Applicability: Single parents. Tax Class 2 applies to single parents in Germany. If you are a single parent, you can benefit from steuerklasse 2.

- Tax Rate: More favorable than Tax Class 1. The tax rate for individuals in Tax Class 2 is more favorable compared to Steuerklasse 1. This means that single parents may have a lower tax liability and potentially pay less in taxes.

- Advantages: Tax benefits to alleviate financial burdens. One of the advantages of Tax Class 2 is the availability of tax benefits specifically designed to alleviate financial burdens for single parents. These benefits can include higher child allowances, tax credits, or deductions related to childcare expenses.

- Considerations: Requirements for qualification, and documentation needed. Single parents in Tax Class 2 need to meet certain requirements to qualify for these tax benefits. These requirements may include being the sole caretaker of the child, having the child live in the same household, and not having a partner who contributes significantly to the child’s care or income.

German tax class 3: Married, One High Earner

- Applicability: Married couples with significant income disparity. Tax Class 3 applies to married couples in Germany who have a significant income disparity. This means that if one spouse earns significantly more than the other, they may consider opting for Steuerklasse 3.

- Tax Rate: Lower for the higher-earning spouse. The tax rate for individuals in Tax Class 3 is lower for the higher-earning spouse. This means that the higher-earning spouse will have a lower tax liability compared to what they would have in Tax Class 1.

- Advantages: Utilizes splitting rule for tax savings. One of the advantages of Tax Class 3 is the utilization of the splitting rule for tax savings. This rule allows the couple to distribute their income in a way that maximizes overall tax savings. By shifting a portion of the higher-earning spouse’s income to the lower-earning spouse, they can potentially benefit from reduced taxable income and lower tax rates.

- Considerations: Active selection is required, beneficial for one partner with little to no income. It is important to note that actively selecting Tax Class 3 is required. This means that the couple needs to actively choose this tax class when filing their tax return. By actively selecting Tax Class 3, the couple can optimize their tax position and potentially save on overall taxes paid.

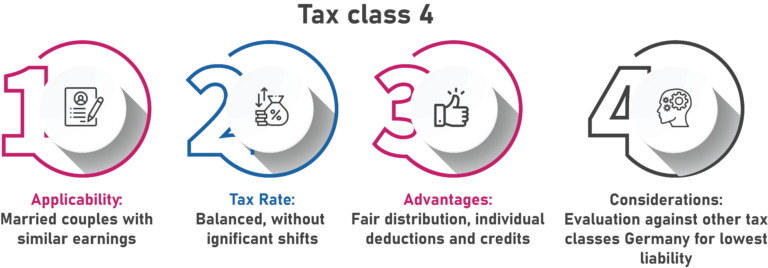

German tax class 4: Married, Similar Incomes

- Applicability: Married couples with similar earnings. Tax Class 4 applies to married couples in Germany who have similar earnings. This means that if both spouses earn similar incomes, they may opt for Tax Class 4.

- Tax Rate: Balanced, without significant shifts. The tax rate for individuals in Tax Class 4 is balanced, without significant shifts. This means that the tax rates for both spouses are generally the same, resulting in a balanced distribution of the overall tax burden.

- Advantages: Fair distribution, individual deductions and credits. One of the advantages of Tax Class 4 is the fair distribution of taxes between both spouses. Since the tax rates are balanced, neither spouse is disproportionately burdened with a higher tax liability compared to the other spouse.

- Considerations: Evaluation against other tax classes Germany for lowest liability. Married couples in Tax Class 4 need to evaluate their tax liability against other Germany tax classes to determine if they can achieve the lowest possible tax liability. While Tax Class 4 ensures a fair distribution of taxes, it may not always result in the lowest overall tax liability for the couple.

German tax class 5: Married, Partner in Class 3

- Applicability: Married individuals with a partner in Tax Class 3. Tax Class 5 is applicable to married individuals in Germany who have a partner in Tax Class 3. This means that if one spouse is in Tax Class 3, the other spouse can opt for Tax Class 5.

- Tax Rate: Higher for the lower-earning or non-earning spouse. The tax rate for individuals in Tax Class 5 is higher for the lower-earning or non-earning spouse. This means that the lower-earning or non-earning spouse will have a higher tax liability compared to what they would have in Tax Class 1 or Tax Class 4.

- Advantages: Balances overall tax burden between spouses. One of the advantages of Tax Class 5 is that it balances the overall tax burden between spouses. Since the higher-earning spouse is in Tax Class 3 with a lower tax rate, this helps offset the higher tax liability of the lower-earning or non-earning spouse in Tax Class 5. It ensures a more equitable distribution of the overall tax burden within the marriage.

- Considerations: Active choice is required, part of a split-taxation system. Tax Class 5 is part of a split taxation system in Germany. This means that the income of married couples is divided between the spouses for tax purposes. Each spouse is taxed separately based on their respective tax classes.

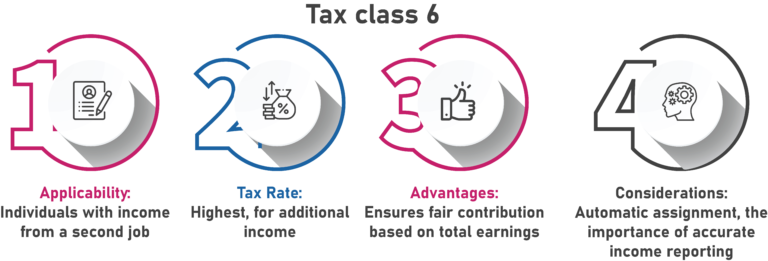

German tax class 6: Second Job Income

- Applicability: Individuals with income from a second job. Tax Class 6 applies to individuals in Germany who have income from a second job. If you have income from a second job, you will be automatically assigned to Tax Class 6.

- Tax Rate: Highest, for additional income. The tax rate for individuals in Tax Class 6 is the highest compared to other tax classes in germany. This means that the additional income from the second job will be taxed at a higher rate, ensuring a fair contribution based on the total earnings.

- Advantages: Ensures fair contribution based on total earnings. One of the advantages of Tax Class 6 is that it ensures a fair contribution from individuals with income from a second job. Since the tax rate is higher for this additional income, individuals are paying a higher percentage of their earnings in taxes. This helps maintain a fair and equitable tax system.

- Considerations: Automatic assignment, the importance of accurate income reporting. Tax Class 6 is automatically assigned to individuals with income from a second job, so you do not need to actively choose this tax class. However, it is still important to understand the implications of being in Tax Class 6 and to accurately report your income to ensure compliance with tax regulations.

How does the tax system in Germany work?

Residents who earn money in Germany are required to contribute a portion of their earnings to the government. This ensures that everyone pays their fair share towards the community. The income threshold at which this contribution begins is currently set at 9,168 euros per year. This obligation to pay taxes applies not only to employees but also to pensioners and the self-employed. Regardless of the source of income, individuals are subject to the same income tax regulations and must fulfill their tax obligations accordingly. Income tax must be declared and paid annually. It is calculated based on an individual’s total annual income, taking into account various sources of income such as employment earnings, pension payments, or income from self-employment. The tax rate is determined based on a progressive system, where higher income levels are subject to higher tax rates. Employees, pensioners, and the self-employed are responsible for calculating their income tax liability based on their total earnings and specific circumstances. They must report their income, deductions, and other relevant information in their annual tax return. This information is used by the tax authorities to determine the applicable tax rate and tax liability. Paying income tax is an essential part of supporting the community and contributing to government revenues. It helps fund public services, infrastructure, and social welfare programs. By fulfilling their tax obligations, individuals ensure that the necessary resources are available to maintain and improve the quality of life in Germany.

What are the different types of taxes in Germany

Benefits in Kind

- Benefits in kind, such as the provision of shares at a lower price, are generally taxable in Germany.

- Employees who receive such benefits need to include their value in their taxable income when filing tax returns.

- New regulations introduced in July 2021 provide flexibility regarding the taxation date for privileged companies.

- These regulations aim to ease the tax burden and give companies more flexibility in managing the tax implications of benefits in kind.

- The specific provisions and requirements of these new regulations may vary depending on individual circumstances and the privileges enjoyed by the company.

- Both employers and employees need to consult with tax professionals or legal advisors to ensure compliance with the latest regulations.

- Staying informed about changing tax regulations and seeking professional advice can help companies and employees effectively navigate the taxation of benefits in kind and manage their tax obligations.

Solidarity Surcharge

- The Solidarity Surcharge is an additional charge in Germany.

- It supports the economic development of eastern Germany, which historically has lagged in growth compared to the western part of the country.

- The surcharge is applied on top of income tax, corporate tax, and capital gains tax for individuals and companies exceeding specific income thresholds.

- Its purpose is to provide financial support for investments and infrastructure development in eastern Germany.

- The specific income thresholds and surcharge rates may vary over time.

- Accurate reporting and compliance are crucial to ensure proper calculation and payment of the Solidarity Surcharge.

- The revenue generated from this surcharge is directed towards projects and initiatives aimed at reducing economic disparities and promoting balanced development.

- Discussions and debates surrounding the Solidarity Surcharge have taken place, with calls for its reduction or elimination.

- Changes in tax regulations and income thresholds may occur in the future to address evolving economic priorities and conditions.

Church tax in Germany

- Church tax in Germany is a voluntary tax.

- It is calculated as a percentage of an individual’s income tax.

- Only registered members of recognized religious institutions can pay church tax.

- The purpose of church tax is to provide financial support to religious communities.

- The specific percentage of the tax varies depending on the state and religious community.

- Church tax is collected by the state on behalf of the religious institutions.

- Individuals must declare their affiliation to a registered religious community to pay church tax.

- If individuals choose not to pay church tax, they may not have access to certain services and benefits provided by the religious institution.

- Individuals who do not pay church tax may be restricted from serving in certain positions within the religious community.

Consumption Taxes in Germany (VAT)

- Value-added tax (VAT) is a consumption tax in Germany.

- It applies to most goods and services.

- The standard VAT rate is 19% as of 2021.

- Certain items are subject to a reduced VAT rate of 7%.

- VAT is collected by businesses from the end consumer and remitted to the tax authorities.

- Businesses can claim VAT credits for the VAT they paid on their own purchases.

- Accurate calculation and reporting of VAT liabilities are essential for businesses to comply with tax regulations.

- Failure to comply with VAT requirements can result in penalties and legal consequences.

- VAT invoices are required to provide transparent information about the VAT breakdown in commercial transactions.

- VAT regulations may vary across EU member states, and cross-border transactions within the EU require an understanding of the respective VAT rules and obligations.

Wage Tax and Income Tax in Germany

- Wage tax (Lohnsteuer) is deducted directly from an employee’s salary.

- It serves as a significant source of revenue for the government.

- Income tax (Einkommensteuer) applies to income from various sources, including self-employment.

- Income tax must be declared annually through the filing of a tax return.

- Employers are responsible for withholding and remitting wage tax on behalf of employees. Income tax is calculated on an individual’s total annual income.

- Various deductions, allowances, and exemptions are available to reduce income tax liability.

- Wage tax is withheld throughout the year, while income tax is declared and paid annually.

- Understanding the differences between wage tax and income tax, as well as available deductions and allowances, can help individuals optimize their tax position.

Understanding taxes for locals and expats in Germany:

International Taxes in Germany

- Germany has multiple tax treaties with other countries to prevent double taxation on international income.

- These treaties determine the tax treatment of income earned abroad.

- The allocation of taxing rights is determined based on factors like residence, location of income-generating activities, and nature of income.

- Tax treaties provide relief mechanisms to avoid double taxation, such as tax credits or exemptions.

- The specific relief mechanisms vary depending on the provisions outlined in the treaty.

- Tax treaties also facilitate the exchange of information between countries to enforce tax laws and combat tax evasion.

- It is important for individuals and businesses engaged in international activities to be aware of these tax treaties to navigate international taxation effectively.

Tax Returns in Germany:

- Taxpayers in Germany can file their tax returns manually or online using platforms like ELSTER.

- Filing tax returns manually involves completing forms and submitting them in person or by mail.

- Accuracy and compliance with tax regulations are essential when filing tax returns manually.

- Filing tax returns online through platforms like ELSTER offers convenience and a streamlined process.

- Taxpayers can access their tax forms electronically, enter the required information, and submit them online.

- ELSTER also provides notifications, updates, and the ability to track the status of the tax return.

- Various software and services are available to assist with tax return preparation.

- These tools can automate calculations, provide guidance, and help identify deductions and credits.

- Expats and individuals with complex tax situations can benefit from specialized tax services.

- Expert advice can help ensure compliance and optimize the tax position for individuals with international income or specific tax considerations.

What is the penalty for filing late taxes in germany?

Lateness penalty fees for late filing of the German Income Tax Return are calculated based on the total assessed tax due (minus any advance payments or tax deductions). The fee amounts to 0.25% of the total tax assessed. However, the lateness penalty fee must be rounded down to the nearest full euro. There is a minimum penalty fee of 25 euros per month or part of the month that the tax return is late. This means that even if the 0.25% calculation results in a lower fee, the minimum penalty fee of 25 euros per month will still apply. On the other hand, there is a maximum fee of 25,000 euros that can become due depending on the tax liability amount and the length of time the tax return has been overdue. It’s important to note that late filing penalty fees are separate from any interest charges that may be applied to unpaid taxes. Therefore, it is essential to file the tax return on time to avoid incurring these penalties and additional charges. To ensure accurate and timely submission of the tax return, it is recommended to prepare in advance, gather all necessary documentation, and seek assistance from tax professionals or use available software or services. Meeting the deadlines and fulfilling your tax obligations is crucial for maintaining compliance with tax regulations and avoiding financial penalties.

Check your Eligibility Now!

Register: Sign up to get started on your journey with us.

Register: Sign up to get started on your journey with us.

Watch the Videos: Videos designed to elevate your assessment performance.

Take an Assessment: Discover your unique skills with our detailed assessment.

Book your appointment: Make an appointment with us to take the next step in your journey.

FAQs:

What is the difference between German tax classes 3 and 5?

Answer: A higher tax deductible is applied for childcare expenses based on the income distribution within a family. In Tax class III, which applies to married or registered couples where one partner earns up to 60% of the family income, a certain tax deduction for childcare can be claimed. On the other hand, Tax class V is for couples where one partner earns less than 40% of the family income, and they are eligible for a higher tax deductible for childcare expenses.

What is Couple Taxation in Germany?

Answer: When a couple chooses to file their taxes jointly, both parties must provide their signatures on the form to confirm the decision. This choice is binding for the entire taxable income of the calendar year and can only be changed once a year, and that too in writing. Whether a couple opts to file jointly or separately can have a significant impact on their overall tax liability, as each method comes with its own set of benefits and limitations. It is important for couples to carefully consider their financial situation and consult with a tax professional before deciding on how to file their taxes.

What is the tax division in Germany?

Answer: Tax administration in Germany is divided between two main authorities: the Federal Central Tax Office (Bundeszentralamt für Steuern) and the regional tax offices (Finanzämter). The Federal Central Tax Office is responsible for tasks at the federal level, such as customs duties and federal taxes, while the regional tax offices handle taxation matters at the state and local levels. With approximately 650 regional tax offices throughout the country, taxpayers have local offices where they can file tax returns, receive tax advice, and handle any tax-related issues.